Leverage Cryptocurrency

Trading with margin is a great way for advanced traders to increase their potential profits by trading much larger positions. Leverage trading (or margin trading, as it is more often known) has hit a new high in the last two years, with companies and groups dedicated to forex selling it as a way to make money with relative ease.

100 A Day Trading On Bybit Cryptocurrency Leverage

100 A Day Trading On Bybit Cryptocurrency Leverage

While binance was always known as a traditional spot cryptocurrency exchange, it has now entered the.

Leverage cryptocurrency. He is profoundly active in the. Bitstarz player lands $2,459,124 record win! In 2019, the popularity of leverage trading (aka margin trading) has grown considerably in bitcoin and cryptocurrency markets.

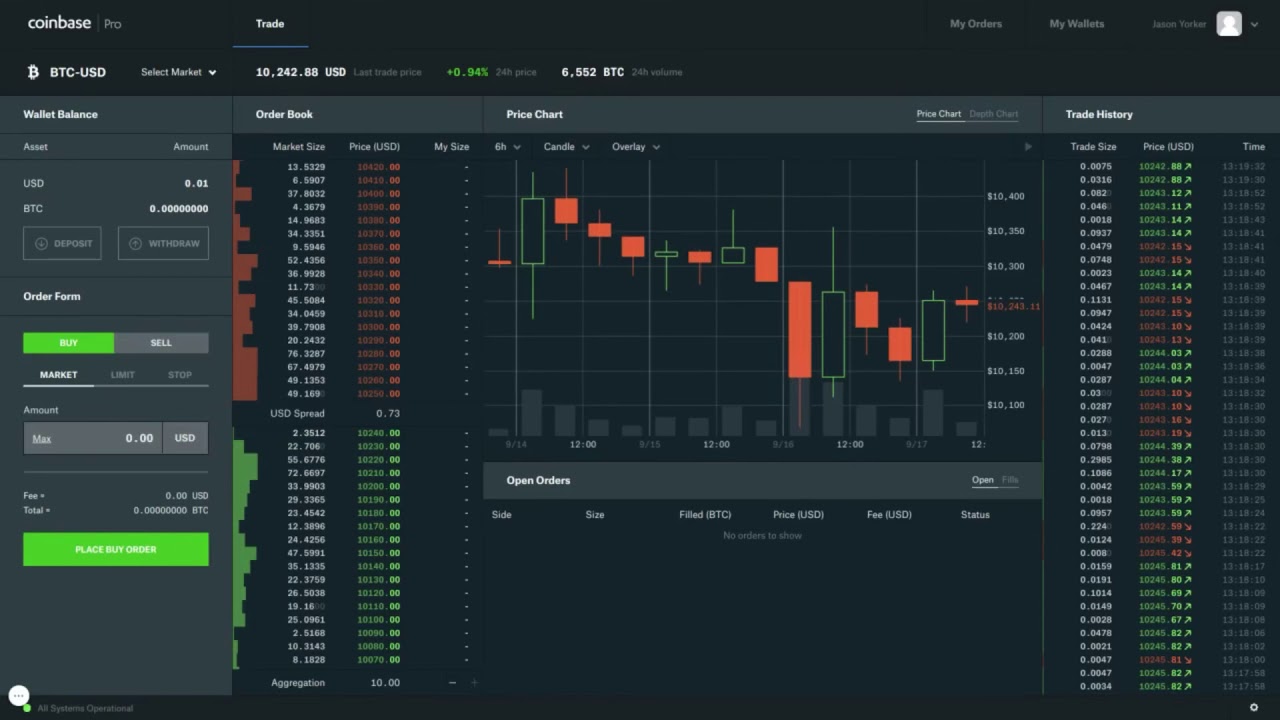

Opening bitcoin longs in concept, leverage trading is quite simple. The full list of digital asset exchanges with a leverage trading here. Cryptocurrency trading or crypto trading is simply the exchange of cryptocurrencies.

Cryptocurrency brokerage firms are still permitted to operate in the usa, only as exchange platforms. Do not trade cryptocurrencies with leverage unless you are fully aware of what you are doing and what risks you face. How to trade bitcoin contracts with up to 125x leverage on binance.

Cryptocurrency trading is rated as highly volatile with the window for gains and losses swinging either way. This is what we mean; Dedicated cryptocurrency derivatives platforms normally offer relatively high leverage to all traders, regardless of how much cryptocurrency they deposit.

The fees are depending on the volume of the margin account. The usage and issuance of cryptocurrencies is a thorn in the side of central banks and governments. Us traders must know, that they are not allowed to maintain margin positions longer than 28 days on kraken.com.

You need to know risk management and concepts of technical analysis before you hop on to take a leverage trade. This tends to be the case for crypto leverage trading usa brokers. Pros & cons of leverage trading cryptocurrency cryptocurrency margin trading strategies the final word before you get started though, you need to put in the research.

Could you be next big winner? This allows you to open larger positions than your account would normally allow. The leverage works like the law of physics:

Open positions will automatically be liquidated after that period. This leverage can be acquired through the use of better mining equipment like asics which provide a higher. As always, the level of risk management should be commensurate with the complexity of the products and services offered.

You can lose your entire crypto assets you have by making one wrong move by leverage trading without knowledge. They allow trading at a smaller leverage of up to 5:1, depending on the currency pair, which seems feasible. As a lever, enables the traders to enter into transactions that they would not be able to do with their own funds only.

Having the ability to break out of a siloed environment needs to be a basic right for anyone. You can make the most of. Let’s say you have up to 1 btc on december 17, 2017, at a peak value of above $19,764.

Thus, we can buy $500 worth of stock with only $100. $100 x 5 = $500. It may occur to you that you can use higher leverage to buy the same shares with less capital.

It enables you, as the trader, to open a trade of a larger size with a smaller amount of invested capital. Today, the total cryptocurrency market capitalization stands at $269 billion with over 5,500 cryptocurrencies making up this volume. However, we have seen a boom of leverage trading in the forex market as well.

Leverage is presented in the form of a multiplier that shows. List of brokers with crypto leverage trading for us traders How to trade using margin

Bitcoin holds the largest crypto market cap of $175 billion out of the total market capitalization. The last 12 months the cryptocurrency market has seen a surge in demand for cryptocurrency trading exchanges that offer derivatives and futures markets with leverage. Leverage trading on cryptocurrency is the riskiest.

How to leverage cryptocurrency and make a profit when the market falls. Bitcoin bitcoin exchanges bitcoin leverage bitcoin trading leverage cryptocurrency digital currency opinion. Leverage, otherwise known as risk level, is a temporary loan given to the trader by the broker.

You can use leverage on most of your trades on most leading cryptocurrency exchanges, such as binance, bitfinex, or bitmex. One of the many benefits of crypto leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. This business is just a replicate of the traditional trading in traditional bond and stock markets.

Primexbt , basefex and bitmex are examples of exchanges that offer up to 100x leverage to all users. Cryptocurrency leverage trading is a highly profitable trading strategy that most crypto enthusiasts still do not apply till date because most crypto exchanges don’t offer the service. It is a way of gaining exposure to large amounts of cryptocurrency without having to put up the full amount of capital into a trade at the start

Leveraged trading can be a valuable tool for every bitcoin trader that’s searching for profits in the cryptocurrency market, as it allows traders to enter larger positions by committing a smaller amount of capital. Win up to $1,000,000 in one spin at cryptoslots. Margin trading terms & concepts;

Leverage is a service that brokerage firms provide, as a loan in the form of cash or securities for a trader to close a deal. They consider it too risky to offer this strategy to their traders or investors. Leverage is available at kraken up to 5x for several cryptocurrency pairs, including bitcoin.

There are a lot of brokers out there that don't allow crypto and forex trading all in the one place. The occ expects banks to leverage such bsa/aml experience when offering new payment systems to properly address the unique risks related to cryptocurrency transactions. Traders can use leverage to open both long and short positions, allowing them to make a profit and bet on a cryptocurrency’s price going in either direction.

$100 x 10 = $1,000. Leverage is one of the more powerful tools in trading cryptocurrency and works well for profit making on a volatile asset. This trend can be seen with the comparable growth of the trading…

For example, if you place a margin trade with a leverage of 2.0, only half of the size of this position is used as initial margin, and with 5.0 only a fifth is needed. Thus, we can buy $1,000 worth of stock with only $100.

what is leverage? (Margin Trading Explained

what is leverage? (Margin Trading Explained

Gain Profit By A Better Margin Leverage Cryptocurrency

Gain Profit By A Better Margin Leverage Cryptocurrency

How to Leverage Trade Cryptocurrency Exchange Ratings

How to Leverage Trade Cryptocurrency Exchange Ratings

How to Trade with Leverage [Bitcoin & Cryptocurrency]

How to Trade with Leverage [Bitcoin & Cryptocurrency]

Best Cryptocurrency Trading Platforms With Leverage

BYBIT BITCOIN & CRYPTOCURRENCY LEVERAGE TRADING TUTORIAL

BYBIT BITCOIN & CRYPTOCURRENCY LEVERAGE TRADING TUTORIAL

XBT/USD Bitmex long 3740.00 100X leverage. CryptoCurrency

XBT/USD Bitmex long 3740.00 100X leverage. CryptoCurrency

How to Leverage Trade Cryptocurrency Exchange Ratings

How to Leverage Trade Cryptocurrency Exchange Ratings

Setting leverage when opening a position Cryptocurrency

Setting leverage when opening a position Cryptocurrency

TradeHerald The First 100x Leverage Cryptocurrency

TradeHerald The First 100x Leverage Cryptocurrency

Leverage and Margin Trading Exchange Software Crypto

Leverage and Margin Trading Exchange Software Crypto

Stacks Network to Leverage BTC’s Proof of Work and Burn

Stacks Network to Leverage BTC’s Proof of Work and Burn

Cryptocurrency Leverage Trading Intro (Part 2) There's

Cryptocurrency Leverage Trading Intro (Part 2) There's

Understanding why Cryptocurrency Leverage Trading commands

Understanding why Cryptocurrency Leverage Trading commands

Leverage Trading Enriching Cryptocurrency Exchanges

Leverage Trading Enriching Cryptocurrency Exchanges

Finding the best cryptocurrency leverage trading platforms

Finding the best cryptocurrency leverage trading platforms

CRYPTOCURRENCY LEVERAGE TRADING Definition, How It Works

CRYPTOCURRENCY LEVERAGE TRADING Definition, How It Works

Comments

Post a Comment